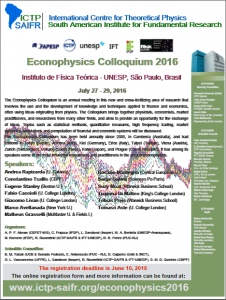

The Econophysics Colloquium is an annual meeting on this new and cross-fertilizing area of research that involves the use and the development of knowledge and techniques applied to finance and economics, often using ideas originating from physics. The Colloquium brings together physicists, economists, market practitioners, and researchers from many other fields, and aims to provide an opportunity for the exchange of ideas. Topics such as statistical methods, quantitative measures, high frequency trading, market dynamics, simulations and computation of financial and economic systems will be discussed.

Contact: econophysics2016@gmail.com

Brief History

The Econophysics Colloquium has been held annually since 2005, in Camberra (Australia), and had editions in Tokyo (Japan), Ancona (Italy), Kiel (Germany), Erice (Italy), Taipei (Taiwan), Viena (Austria), Zurich (Switzerland), Pohang (South Korea), Kobe (Japan), and Prague (Czech Republic). It has among its speakers some of the most influential researchers and practitioners in the area of econophysics.

Location: São Paulo, Brazil

Venue: IFT-UNESP

Confirmed Speakers:

- Siew Ann Cheong (Nanyang Technological University): Financial Market Crashes Can Be Quantitatively Forecasted

- Andrea Rapisarda (INFN Sezioni di Catania – U. Catania, Italy): Financial markets, Self-organized criticality and Random strategies

- Constantino Tsallis (CBPF, Brazil): Universality in the Interoccurence times in finance and elsewhere

- Fabio Caccioli (University College London, UK): Portfolio Optimization under Expected Shortfall: Contour Maps of Estimation Error

- Giacomo Livan (University College London, UK): Complexity driven collapses in large random economies

- Matheus Grasselli (McMaster University and Fields Institute, Canada): Macroeconomic modelling with heterogeneous agents: the master equation approach

- Rosário Mantegna (Central European University, Hungary): Trading networks at NASDAQ OMX Helsinki

- Suzy Moat (Warwick Business School, UK): Measuring economic behavior using online data

- Tiziana Di Matteo (King’s College London, UK): Multiplex dependence structure of financial markets

- Tobias Preis (Warwick Business School, UK): Sensing human activity using online data

Announcement

Program: updated on July 25

Click on the (video) to watch the videos and (PDF) to download the lecture files

|

Wednesday, 27 |

Thursday, 28 |

Friday, 29 |

|

|

8:30 – 9:15 |

Registration |

||

|

9:15 – 9:30 |

Welcome |

||

|

9:30 – 10:30 |

Universality in the Interoccurence times in finance and elsewhere (C. Tsallis) |

Multiplex dependence structure of financial markets (T. Di Matteo) |

Measuring economic behavior using online data (S. Moat) |

|

10:30-11:00 |

Coffee Break |

Coffee Break |

Coffee Break |

|

11:00-12:00 |

Financial markets, Self-organized criticality and Random strategies (A. Rapisarda) |

Sensing human activity using online data (T. Preis) |

Portfolio Optimization under Expected Shortfall: Contour Maps of Estimation Error (F. Caccioli) |

|

12:00-14:00 |

Lunch |

Lunch |

Lunch |

|

14:00-15:00 |

IFT-Colloquium: A Brief Overview of More than 25 Years of Econophysics (R. Mantegna) |

Dynamics of synchronicity of trading decisions of investors at the Nordic Stock Exchange (R. Mantegna) |

Complexity driven collapses in large random economies (G. Livan) |

|

15:00-16:00 |

Poster Session

|

Financial market crashes can be quantitatively forecasted (S. Ann Cheong) |

Parallel Sessions 2A and 2B |

|

16:00-16:30 |

Coffee Break |

Coffee Break |

Closing |

|

16:30 – 17:30 |

Macroeconomic modelling with heterogeneous agents: the master equation approach(M. Grasselli)(video) (PDF) | Discussion Groups: Financial crises and systemic risk | |

|

17:45-18:45 |

Parallel Sessions 1A and 1B |

Discussion Groups: Critical transitions in markets |

|

|

19:00-22:00 |

Dinner |

Photos

Booklet:

Places:

Auditorium

- Plenary Talks

- Parallel Session 1A

- Parallel Session 2A

- Discussion Groups: Financial crises and systemic risk

- Discussion Groups: Critical transitions in markets

Room 3, 3rd floor

- Parallel Session 1B

- Parallel Session 2B

Organizing Committee:

- Allbens P. F. Atman (CEFET-MG, Brazil)

- Carlos Frajuca (Instituto Federal de Educação, Ciência e Tecnologia de São Paulo – SP, Brazil)

- Leonidas Sandoval (Insper, Brazil)

- Mário Augusto Bertella (UNESP-Araraquara, Brazil)

- Nanci Romero (Instituto Federal de Educação, Ciência e Tecnologia de São Paulo – SP, Brazil)

- Rogério Rosenfeld (ICTP-SAIFR & IFT-UNESP – SP, Brazil)

- Rosane Riera Freire (PUC-RJ, Brazil)

Local Scientific Committee:

- Benjamin M. Tabak (Universidade Católica de Brasília & Senado Federal – DF, Brazil)

- Célia Anteneodo (Pontifícia Universidade Católica – RJ, Brazil)

- Daniel Cajueiro (UnB & INCT – Complex Systems – DF, Brazil)

- Giovanni L. Vasconcelos (Universidade Federal de Pernambuco – PE, Brazil)

- Leonidas Sandoval (Insper, Brazil)

- Rogério Rosenfeld (ICTP-SAIFR & IFT-UNESP – SP, Brazil)

- Sílvio M. D. Queirós (CBPF – RJ, Brazil)

================================================================================================================

Additional Information

List of Confirmed Participants: Updated on July 20

Registration: ALL participants should register. The registration will be on July 27 at the institute, from 8:30 to 9:15. You can find arrival instructions at http://www.ictp-saifr.org/?page_id=195.

Accommodation: Participants, whose accommodation has been provided by the institute, will stay at The Universe Flat. Each participant, whose accommodation has been provided by the institute, has received the accommodation details individually by email.

Poster presentation: Participants who are presenting poster MUST BRING THE POSTER PRINTED. The poster size should be at most 1,5m x 1m. Please do not bring hanging banner, only sticking poster.

Emergency number: 9 8233 8671 (from São Paulo city); +55 11 9 8233 8671 (from abroad), 11 9 8233 8671 (from outside São Paulo).

Ground transportation instructions:

Ground transportation from Guarulhos Airport to The Universe Flat

Ground transportation from Congonhas Airport to the Universe Flat

Ground transportation from The Universe Flat to the institute

================================================================================================================

VISA Information: Due to the Olympic Games to be held in Rio de Janeiro from August 5- 21 some nationalities (USA, Canada, Japan, and Australia) will be exempt from visas from June to September, 2016.

Econophysics Colloquium Fee: Because this workshop is not receiving financial support from ICTP-SAIFR, there is a required registration fee for all participants:

- bank deposit (for locals, non-students): R$ 700 .

Bank: Banco do Brasil

Agency: 5806-8

Account (conta corrente): 26.404-0

CPF number (for the option DOC transfers): 027.504.408-40

- by international money order, SWIFT: BRASBRRJSPO – IBAN: BR8000000000058060000264040C1.

Bank: Banco do Brasil

Branch number: 5806-8

Account number: 26404-0

Branch address: Rua Julio Conceicao, 438, CEP 01126-000, São Paulo, SP, Brazil

Beneficiary’s name: Nanci Romero

After making the payment, please send a scanned copy of your payment receipt to secretary@ictp-saifr.org and your registration will be completed.

Publication: A selection of papers will be published in the Journal of Network Theory in Finance as a special issue on Econophysics